East & Partners Business Banking Index (BBI) measures business customer sentiment towards banks. Using an inquisitive and reflective approach, the index monitors the advocacy, detraction, empathy, satisfaction, loyalty and mind share of business banking customers. The sentiment indicators gathered from the program provides the key to forecasting market performance and outcomes across segments.

The BBI provides key insights on how banks are engaging with their commercial customers, and delivers competitive analysis on how each bank is performing against benchmarks. This crucial information can be used to identify opportunities in the marketplace where customers are being underserviced and the likelihood of refinancing is high.

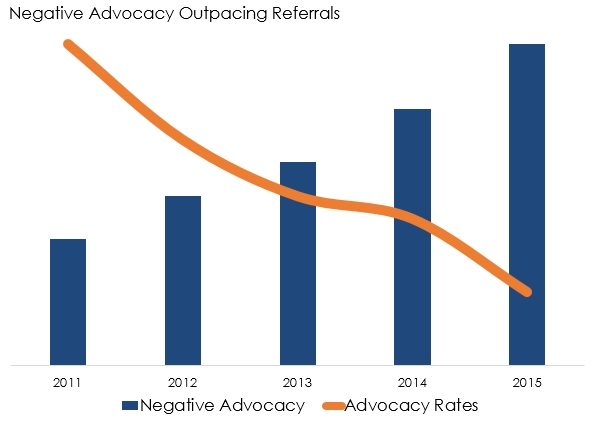

Further opportunities can be garnered through advocacy metrics. Not only are these key to understanding customer attitudes, but also the likelihood of referring colleagues to their current provider.

Mindshare aids in determining whether a broader strategy is having the desired effect. With product offerings from banks becoming somewhat homogenous in the customers view, mindshare and advertising recall data deliver feedback on whether or not marketing campaigns targeted towards businesses are impacting perceptions. Mindshare is also directly correlated to future market share growth, as decision makers are drawn to providers they feel are experts in this area of banking.

Micro and SME businesses make up a large portion of Australian enterprises. However these segments are increasingly disenchanted with their current banking relationships. Sentiment scores recorded are only half of those achieved amongst larger firms.

Understanding these customer’s needs will open up revenue streams if the correct service proposition can be developed for customers who are looking for an alternative.

Traditional financial service providers are also seeing new competitors that are aiming to exploit gaps in the market. While these disrupters are still in their infancy and considered niche providers, they are gaining momentum and distinguishing themselves by catering to the needs of businesses and exploiting opportunities.

The BBI Index identifies “at risk” customers who may be vulnerable to these niche providers.

| Distribution by Enterprise Segment | % of Total |

| Micro Business | 27 |

| SME | 29 |

| Corporate | 23 |

| Institutional | 21 |

Subscribe

Subscribe