The Australian Asset & Equipment Finance Markets program represents the only standalone research program of its kind, providing key competitive market positioning statistics, customer satisfaction ratings, credit process, customer churn, broker engagement, underlying demand drivers and proprietary volume analysis. East & Partners has continuously interviewed +/- 1,300 asset and equipment finance market participants each year since 2006.

Equipment financing and leasing facilitates over 40 percent of total capital expenditure for Australian enterprises according to the Australian Bureau of Statistics (ABS). This includes the replacement of existing assets in addition to the purchasing of new productive assets, representing a significant proportion of total business borrowing for small businesses in particular.

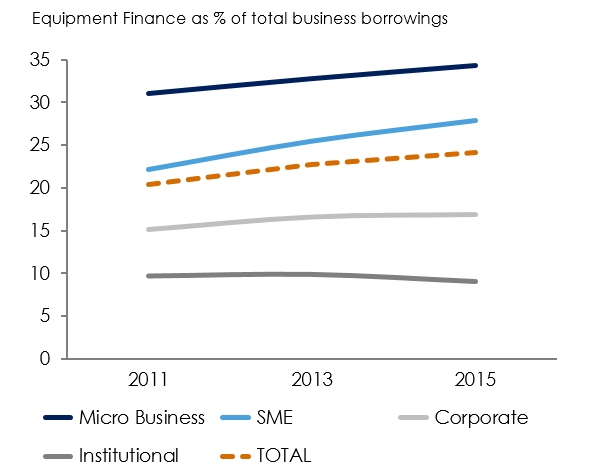

Small businesses continue to increase their engagement with equipment finance providers, with equipment financing as a proportion of total borrowing expanding to 34.3 percent for Micro businesses and 27.9 percent for SMEs in 2015. In comparison, equipment financing within the institutional segment accounted for less than 10 percent of total borrowings.

Corporates usage of finance leases, operating leases, novated leasing, chattel mortgages and commercial hire purchase products has steadied at 16.9 percent of total borrowings, less than half that of Micro businesses.

As Micro businesses and SMEs seek to more actively manage working capital constraints, they are increasingly seeking innovative and cost effective equipment finance providers to acquire or replace plant and equipment.

While many small business owners continue to consider the broker channel based on a perception of better pricing, the banks increasingly view equipment finance as a product which can be sold into existing primary lending and transaction banking relationships.

61 percent of respondents nominate their relationship bank as a preferred source for equipment finance solutions however a growing 36 percent of businesses reported ‘no preference’. The two largest providers by market share, NAB and GE, struggled to maintain long running growth trends in 2015.

In contrast, Westpac and CBA achieved significant primary market share growth. These growth trends are set to continue through 2016 across segment, state and sector verticals.

| Distribution by Enterprise Segment | % of Total |

| Micro Business | 28 |

| SME | 34 |

| Lower Corporate | 26 |

| Institutional | 14 |

Subscribe

Subscribe